Timologio (invoice) for WooCommerce

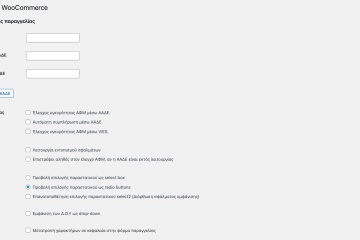

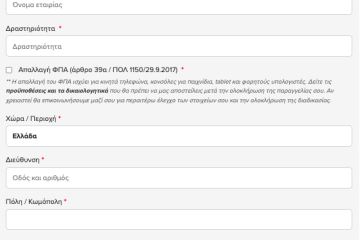

The Timologio (Invoice) for WooCommerce plugin allows the user to choose whether to issue a receipt or invoice when completing an order. In case of invoice selection, the fields Company Name, Tax Identification Number, Tax Identification Number and activity must be displayed, without display problems or incorrect messages.

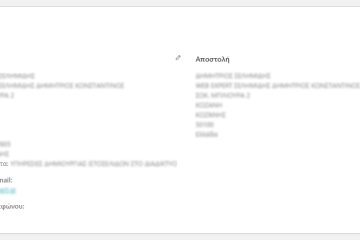

The data entered by the user are in the appropriate places in the administration area, while they are normally displayed in the order emails, as well as in the user account.

Features

- Issuance of invalid documents (receipt or invoice)

- Creating an order note

- Possibility of uploading valid documents (through tax mechanism)

- Possibility of credit/ cancellation documents

- Sending documents via email

- Optional VAT validity check via IAPR

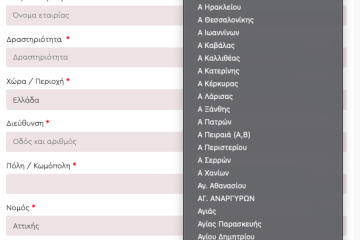

- Automatic completion of invoice fields (DOY, Activity, Company Name, City, Address & Zip Code)

- Optional VAT validity check via VIES

- Optional VAT exemption based on VIES

- Optional third country (non-EU) VAT exemption

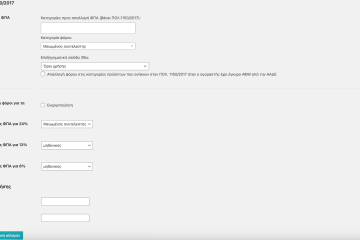

- Optional VAT exemption based on POL.1150/2017

- Optional exemption under a. 39a

- Optional conversion of characters to uppercase

- Correct field naming

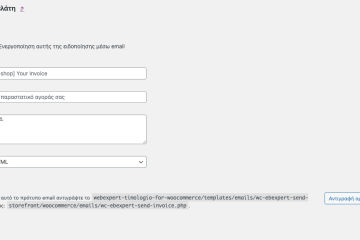

- Ability to modify document sending email

- Correct placement of fields in the order form and email

- Possibility to search for orders based on VAT number

How is your plugin different from other techniques or plugins?

There are various techniques or other plugins that allow you to enter invoicing fields when ordering, but none are as effective. The Timologio (invoice) for WooCommerce plugin differs because:

- Supports automatic extraction/ completion of data through IAPR

- Supports validation control through IAPR

- Supports validation testing via VIES

- Makes an optional VAT exemption based on POL.1150/ 2017 and article 39a

- Enables auto-filling of invoice fields on order completion page and order processing

- Issues invalid documents

- It is possible to upload valid documents

- It does not display false markings, such as “optional” when invoicing fields are required

- Displays the invoicing fields in the correct order

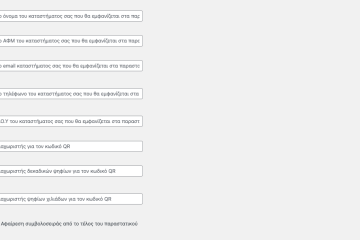

- Pricing details are included wherever WooCommerce calls for these items (order pages, user account area, emails)

- They are saved as a custom field in the user, and not in the order, so the user does not need to type them every time they create a new order

- Uses proper structure, programming structure and functions of WordPress and WooCommerce

If you face any issue regarding the configuration of the plugin, you can contact us at support@webexpert.gr

Γιατί να διαλέξετε την Web Expert

Quick & instant installation

We undertake to install the plugin immediately from the moment of purchase of the plugin! Contact us to do the installation!Upload & edit licenses at any time

You can find and download the plugin at any time through the account uploads you have created on our site.Free support & lifetime automatic updates

Our plugin license includes free updates and lifetime automatic updates without any annual subscription!Check the validity of VAT through IAPR & VIES

The AFM validity check serves the automatic completion of the invoice fields at the checkout.VAT exemption based on POL.1150/2017 & article 39a

VAT exemption for the categories of products you choose.Ability to upload valid documents

You can upload valid documents within each order.Συλλογή εικόνων

Only logged in customers who have purchased this product may leave a review.

Ερωτήσεις

How to install a payment gateway?

Installing the plugin is a very simple process. First, you will need to download the plugin from the Web Expert members area and save it to your computer. Then, on your website, from the WordPress admin area, go to “Plugins>Add New Plugin” and select “Upload Plugin”. Finally, you select the file you saved on your computer and select “Install Now”. For more information look up the corresponding README file that comes with the plugin or consult the plugin’s documentation.

What can I do if I get an invalid license while I have entered it correctly?

First, you can try to remove the license key from the plugin settings, select save settings, and then enter it again.

In the event that the server that serves you blocks the communication to webexpert.gr, the license check cannot be carried out. You can contact your provider and ask to whitelist our IP addresses: 5.9.116.30 and 5.9.116.27.

What settings are needed for the plugin to work?

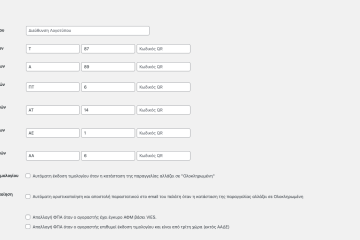

For the plugin to work properly, you need to have your business headquarters information completed on the WooCommerce home settings screen (WooCommerce> Settings> Store Address), with the rest of the settings on the plugin page. Also, make sure you have the tax set up correctly in WooCommerce. Specifically, a separate reduced tax rate for the islands will then need to be set up in WooCommerce tax (you don’t need to have an area code, zip code and city).

Where can I find the information of the invoice?

The invoicing details are placed on the order page, in the first table together with the other billing details of the order. This ensures that you can easily locate them and include them in any email sent by WooCommerce to users.

Why the checkout fields aren’t showing up correctly?

Our plugin is compatible with WooCommerce’s default checkout fields. If you’re using another plugin that affects them, it might causes conflicts and cant’ display them correctly. Also, it is likely that your CSS hides the information our plugin generates.

At what fields does the autocomplete take place?

The auto-completion of the invoice fields (DOY, Activity, Company Name, City, Address & Zip Code) is done on the order completion page as well as in the WordPress admin area of the order processing.

Why doesn’t the automatic data completion via IAPR at the checkout work?

You should make the interface with IAPR through the plugin. Our plugin works with WooCommerce predefined fields. If something affects the fields, a conflict can occur. Specifically, the use of the Checkout Editor is not recommended.

How does the IAPR system work?

To check the validity of a VAT number, your login details to IAPR (VAT number, TAXISnet login name & special password) and special software that communicates with the IAPR system are used. When completing an order, if the customer chooses that he wants an invoice and enters his VAT number, an immediate check is made. If you have activated the automatic completion of the data, the data will be extracted from IAPR. If you have activated the VAT exemption, VAT will be deducted immediately from the total cost of the order.

How does the VIES system work?

To check the validity of a VAT number, special software is used that communicates with the VIES system. When completing an order, if the customer chooses that he wants an invoice and enters his VAT number, an immediate check is made. The auto-completion of the invoice fields does not work in VIES but only in IAPR. If you have activated the VAT exemption, VAT will be deducted immediately from the total cost of the order. You should make the interface with IAPR through the plugin.

How can I give an exemption based on POL.1150 / 2017?

To exempt a user from VAT based on POL.1150/2017, go to the add-on settings, select the product categories you wish to apply and activate the corresponding option so that it appears on the order completion page. The customer will have the opportunity during the completion of the order to choose whether he wishes the VAT exemption.

How can I give an exemption based on a. 39a?

To exempt a user from VAT based on a. 39a, go to the plugin settings, select the product categories you wish to apply and activate the corresponding option to appear on the order completion page. You will also need to create a page in the eshop about the requirements and supporting documents that the customer should have, and set it within the plugin settings. The customer will have the opportunity during the completion of the order to choose whether he wishes the VAT exemption.

Is it connected with myData?

Our plugin is not connected to myData, but only to IAPR from where your details are verified and the autocomplete of the invoice’s fields is conducted.

Can I change the content of the email?

You can modify the theme, header as well as add additional text through the WooCommerce Settings.

How can I edit the structure and content of the email?

You can modify the email subject from the WooCommerce Email settings. To modify the message the customer receives, you need to override the template in your theme, just like with all WooCommerce Emails.

How can I modify the format of the pdf file?

You can intervene and change the format of the pdf, through the plugin’s template code. In particular, you will need to override it in the template of the child theme you are using.

How do I connect the eshop with IAPR?

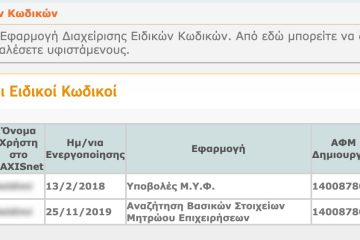

To activate validation through IAPR, you must visit the website https://www.aade.gr/epiheiriseis/forologikes-ypiresies/mitroo/anazitisi-basikon-stoiheion-mitrooy-epiheiriseon and follow the 3 steps:

- Register in the service using the TAXISnet codes.

- Obtaining special password through the Special Password Management application.

- Enter the above credentials in the settings of the plugin.

For more details look up to the plugin’s documentation.

How is VAT reduced for the islands through the plugin?

First you will need to have completed the interface with IAPR through the plugin settings. Make sure that the information you have filled in is valid and that you have enabled VAT validation in the plugin settings. A separate reduced tax rate for the islands will then need to be set up in WooCommerce tax (you don’t need to have an area code, zip code and city). Finally, you will need to select the corresponding tax rate in the plugin settings. If you check on the order completion page, make sure you enter a VAT number that belongs to an island and is entitled to VAT reduction.

Προγραμματιστές

The plugin provides filters, where you can pass your own values:

webexpert_timologio_for_wc__label_select

webexpert_timologio_for_wc__label_yes

webexpert_timologio_for_wc__label_no

The hooks we offer are indicative and need modification. They should be added to the child theme’s functions.php.

If you wish to change the label of the selection of the type of the invoice that will appear at checkout (i.e. type of document invoice or receipt)

add_filter('webexpert_timologio_for_wc__label_select','custom_label_for_invoice');

function custom_label_for_invoice() {

return "Type of document";

}

add_filter('webexpert_timologio_for_wc__label_yes','custom_label_for_yes_invoice');

function custom_label_for_yes_invoice() {

return "Invoice";

}

add_filter('webexpert_timologio_for_wc__label_no','custom_label_for_no_invoice');

function custom_label_for_no_invoice() {

return "Receipt";

}

Reviews

There are no reviews yet.